This essay is part of the “The Debt Justice Agenda” series of Progressive International’s Debt Justice Blueprint.

Around the world, people are in debt due to limited access to things that should be public goods: health care, housing, education, child and elder care. As long as these basic necessities of life remain private burdens, rather than socialized goods, the root causes of debt will remain untouched.

This essay makes the case that reviving the commons and supporting all forms of public goods are critical to any blueprint for debt justice. Solutions that focus on greater financialisation risk increasing and prolonging the debt burden. Instead, our goal should be universal access to public goods and services, while building a solidarity economy.

Financial Inclusion or Debt Trap?

In recent times we have seen many organisations promote financial inclusion, or greater access to banks and loans, as the solution to people’s economic troubles. This has gone hand in hand with a push to privatise and monetise essential services. But financialisation only perpetuates indebtedness and offers little beyond minor relief for the world’s wage-poor families. The recent history of microcredit lending in countries of the Global South tragically illustrates this reality: from Bangladesh to Mexico, women were encouraged to take microcredit loans to become entrepreneurs only to find themselves heavily indebted, unable to keep up with payments, and in increasingly exploitative and dangerous relationships.

Today’s forms of indebtedness are unique for the individual isolation they foster. We blame ourselves for our debts and are often too ashamed to admit the extent of our indebtedness. This is one of the reasons why debt justice requires collective solutions and aims for social solidarity among debtors. The two broad domains where these solutions must be enacted are the state, through welfare programs and labor protections, and people’s movements.

Private debt is an intrinsically social problem. Debt not only disrupts the lives of individuals and families but also disturbs the state of the economy as a whole, as repaying individual debts to banks and other lenders takes priority over stimulating growth. Accordingly, it should be treated as an issue of social welfare. In fact, when people borrow to fund their healthcare or education, the problem is not really debt but the lack of a proper and universal state welfare system.

For example, Scandinavian countries exhibit the highest level of private indebtedness in the world, but very low levels of over-indebtedness. Within inclusive welfare systems, debt can become an investment rather than a burden. So, in Scandinavia, private debt in the form of mortgages is a marker of privilege and wealth building. In other settings, one of the most common types of private debt, consumer credit, is a marker of unmet need and leads to over-indebtedness.

Not all welfare programs are the same, and not any welfare system will be successful. India, for example, has recently been instituting cash welfare transfers to certain marginalized groups. Although poor families and individuals need and welcome these transfers, they are typically too small to make a significant difference in people’s lives. They may not be adjusted for inflation, and they usher in complex bureaucratic requirements that create new forms of suffering and inequity. For example, a mistake in one's date of birth or ration card status can necessitate multiple trips to the local government office, or require time to secure documentation, which is no small task for daily wage workers. Ultimately, families sometimes use these cash transfers just to make interest payments on their loans.

Too many conditionalities or a singular focus on poverty reduction may, in the end, backfire. When welfare programs target the poorest without a real acknowledgement of a wide range of social risks and needs (childcare, eldercare, healthcare), the very systems meant to alleviate poverty end up punishing the poor for their spending choices.

We advocate instead for inclusive and universal welfare programs, focused on social rights, such as: the right of a parent to not have to choose between work and parenthood, the right to healthcare and education, and the right to a living wage. This is the sort of inclusion that stops indebtedness from becoming a problem of over-indebtedness.

Building a Solidarity Economy, Here and Now

Pressuring states to provide robust public goods, while crucial, is clearly an uncertain and long-term program. To make progress in the meantime, activists and local movements throughout the world, have focused on collective projects like cooperatives and building a solidarity economy more broadly. What might this look like, and how would it advance the cause of debt justice? Examples exist in numerous places.

In the U.S., Cooperation Jackson in Jackson, Mississippi, a majority Black city, has begun developing a network of democratically-run worker cooperatives. These cooperatives are working toward building a new local economy based on small-scale manufacturing. The program includes management of over fifty plots of land as part of a Community Land Trust (CLT), including ten acres of “Freedom Farms” devoted to food security and production. The aims of Cooperation Jackson include providing affordable housing and living-wage jobs, which would go a long way toward reducing people’s need to go into debt. Building mutually reliant and supportive institutions is a way to achieve independence from banks, with their histories of both exploiting and excluding Black Americans.

In Kenya, where until 1945 it was illegal for Black Africans to form cooperatives, housing cooperatives are today the main avenue of access to formal housing for low-income Kenyans. The National Union for Housing Cooperatives, for example, a national body anchored in community-based organisations, seeks to empower the urban poor through a collective path to affordable housing and has facilitated the construction of two thousand housing units in a four year period. In a context where the expansion of financial lending apps has led to a crisis of over-indebtedness, and inability to pay rent is a primary reason for indebtedness for millions of Kenyan families, housing cooperatives are an important movement to address one of the root causes of debt.

One final example of building a solidarity economy is that of a community land trust in San Juan, Puerto Rico, which took on renewed importance in the aftermath of Hurricane Maria. When local and federal government failed to adequately respond to the ensuing humanitarian crisis, the surrounding communities mobilized to meet residents’ immediate material needs. The Caño Martín Peña Community Land Trust (winner of the 2015 UN Habitat Award) managed to secure collective land rights for two thousand people on the 200 acres of land on which their homes were built. The area’s residents are among the poorest in Puerto Rico, and collective land rights are a way to avoid gentrification from displacing vulnerable families and driving up local prices.

These examples of community-led transformation show us how cooperative efforts can work toward debt prevention and debt justice. Yet such programs must go hand in hand with systemic and political change, at the national and international levels, to secure access to essential public goods for all. So far, governments and international organisations have pushed “financial integration” as a solution to poverty-reduction and indebtedness because it has been easier to sell and easier to achieve: it panders to business and can be implemented with no public involvement. But its results do little for, and in some cases harm, vulnerable individuals in poor countries as well as rich countries. The solution is not to financialise the things we need and cherish but to make sure that everyone has equitable access to them.

Fareen Parvez and Martino Comelli are members of the Progressive International Debt Justice Collective.

Fareen Parvez is Associate Professor of Sociology at the University of Massachusetts-Amherst.

Martino Comelli is a PhD candidate in Political Science at Central European University.

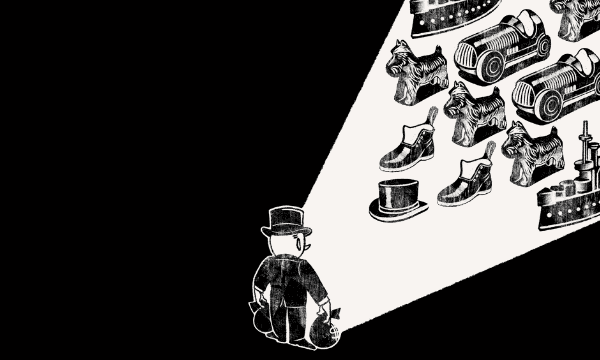

Illustration by Namita Sunil. Namita is a New Delhi based illustrator and graphic artist.

From the Blueprint team at Progressive International

We live in a world of debt. The depth and breadth of global “debtification” is difficult to overstate. It is the primary contention of this collection that all these disparate dynamics — hedge funds raking in pandemic profits, students struggling to afford an education, micro-borrowers on the brink of bankruptcy — are different manifestations of the same basic structural mechanism at the heart of the global financial system: the endless cycle of privatized gains and socialized losses. Simply put, the rich get richer, while the poor, by design, remain poor.

The goal of this Collective is the goal of progressive movements around the world, to end that cycle. Read the full Debt Justice Blueprint here. If you’re interested in engaging with us, please write to the Varsha Gandikota-Nellutla, Blueprint Coordinator at [email protected].