This challenge, he added, needed such immense sums that it “could turn an existential risk into the greatest commercial opportunity of our time.”

People in the financial sector, including many of those licking their lips in the Guildhall, like to say that opportunity and reward are the flip sides of threat and risk. If an investment is risky, then investors demand higher returns. Conversely, low risks should mean low returns, and they often do: German government bonds, for example, are considered so safe they now offer negative yields.

But the happy relationship between risk and reward has substantially broken down in the era of financial globalization. That is because large parts of the financial sector have become dedicated to figuring out ways to divorce the two: in other words, to take the cream from risky activities, while using financial engineering to transfer the risks on to other people’s shoulders.

If the rewards from the climate transition are potentially as immense as Carney suggests, then we must ask about the accompanying risks, and who and what will bear them?

The Wall Street Climate Consensus

To understand where the risks lie, it helps to start with the question of how to pay for the energy transition. According to the International Energy Agency, if the world is to keep to its commitment to limit the global rise in temperatures below two degrees centigrade some $3.5 trillion must be invested annually until 2050 just in investments in the global energy sector. This is comparable to the unprecedented sums governments are now spending on the response to the Covid-19 pandemic — and those sums will have to be repeated, year after year.

How can we raise such astonishing sums? I see three main options.

First, with hefty tax increases. This will not be easy, and must be done very carefully, to avoid the tax burden falling on the shoulders of lower income groups, only exacerbating existing inequalities. As gilets jaunes protests in France, the political challenges to raising sufficient tax revenues to fund the climate transition, especially amid the economic fragility caused by the Covid-19 crisis, are significant. Large taxes on concentrations of wealth and on profitable corporations are essential — excess profits taxes on corporations of 75 percent above a basic profit rate would be a good place to start — but it is not clear if this alone can raise the required sums without economy-crippling (and democracy-sabotaging) taxes on more fragile businesses and poorer households.

The second and by far the best way to finance the transition is massive government-led intervention and spending through a Green New Deal. States would borrow to spend on the low-carbon transition, and use green monetary policies to buy the bonds governments would need to provide the necessary resources. Crucially, states would also regulate carbon heavily, through carbon taxes or levies (with the proceeds returned to the people, to make the transition economically progressive) along with retro-fitting homes and spurring generation of renewables, outright bans or curbs on polluting activities, and terminating an estimated $400 billion in annual subsidies to the fossil fuel industry. Combine this with wealth taxes and excess profits taxes, and the risks and costs of the transition would be placed substantially on the shoulders of the right people: the polluters, those financing them, and the wealthiest sections of society.

All this requires a revolution in economic thinking. Old ideologies about getting the state out of the way to leave the private sector free to do its thing must fall. Perhaps the Covid-19 outbreak will open new political space for this.

But in response to this vision, a third, far more dangerous option is emerging. Daniela Gabor, a renowned expert on finance and shadow banking, calls it the “Wall Street Climate Consensus”. This alluring set of ideas promises that we can tackle climate change without an economic revolution, without coercion, and without public sector borrowing. Instead, the state merely provides nudges and incentives to help the financial sector (with its theoretically unlimited financial resources) raise the funds. Politicians can dodge their responsibilities, and no radical or disruptive political, economic or institutional changes are needed. Happy days!

Here’s how this vision would work.The goodies for the financial sector would include tax incentives, seed funding, loan guarantees, ongoing subsidies for polluting activities, or central banks printing money and buying ‘green’ bonds issued by private companies. Top European officials are already pushing for one of the most dangerous of all subsidies: risky financial deregulation to spur investment in green activities.

Public subsidies would flow not directly into the much-needed transition, but indirectly through the vast shiny turntable of the financial sector and large multinationals, which straddle economic choke points across the economy and milk them to catch the largest possible share for themselves. Under this model, the greater the “commercial opportunity” for finance, the higher the costs for society — and ultimately for the planet.

Greenwashing would be an essential component of this too. As Gabor puts it:

“The incentive for carbon financiers is to stick the label green everywhere they can in preparation for the second step: persuading European regulators to promote (de-risk) green assets.”

Countries like the United Kingdom or Spain, and several poorer states, have long and painful experience with this kind of approach through schemes such as the UK’s Private Finance Initiative (PFI), known elsewhere as Public Private Partnerships. Britain’s Tony Blair, for instance, pushed the financing of traditional public sector activities (like building roads, or schools) out to the financial sector, allowing him to shift borrowing and spending off the government’s books in the short term – but at a massive long-term cost. PFI in Britain has accurately been pilloried by the experts as “one hospital for the price of two.” Had Britain borrowed directly (or raised taxes) to pay for these projects, the savings would vastly outweigh the costs of borrowing. It raises money in the short-term money, but ultimately fewer resources are available for public infrastructure.

To borrow the language of the financial sector, the state should de-risk the climate on behalf of society. Under the Wall Street Climate Consensus, the state will be de-risking the climate on behalf of the financial sector. Once again, the financial sector takes the rewards, the public takes the risks, and the planet’s human and non-human communities bear the costs.

No prizes for guessing which route the European Commission is heading.

This is in significant part a result of Germany’s economically illiterate policies known as “Black Zero” — the idea that public budgets must always, and states must never borrow money — a sickness that has infected the entire European project. Peter Bofinger, a former longstanding member of Germany’s Council of Economic Experts, nimbly summarizes the logic of the German-led European approach.

“Black Zero first, climate second.”

If this happens, then the poorer and middle classes will bear the brunt of any transition that is achieved, however inadequate. And this brings a further set of potent dangers to the climate movement.

Climate justice – or economic justice?

Many people believe that the fight against inequality is separate from the struggle to curb the heating of our climate. I argue that this a dangerous and wrong. The two struggles are inseparable — for two main reasons. First, if the financial sector gets to be the turntable through which the transition happens, its hold over the key economic choke points, through monopolisation and other strategies, will allow it to appropriate wealth for itself. From an economic justice point of view, this will worsen inequality considerably. From a climate perspective, while financing will be leveraged in the short term, there will ultimately be fewer resources available to fund the transition.

Second — and just as important — consider what happens if the immense costs of the transition are borne most heavily by the less wealthy sections of society. Tens of millions of voters across Europe, furious at being shafted by the elites (again!) will be easy prey for the demagogues, oil potentates, fossil fuel magnates, and conspiracy theorists who whip up anger against the green movement – and overturn the whole climate-protection agenda. They have partly succeeded in the United States, Brazil, and other countries already. It must not happen.

How to tackle the Wall Street Climate Consensus

To see the way forward, we need to push in several broad directions.

A first part of any solution is to forge grand strategic alliances between the vast, growing climate movement and the vast, growing movement to tackle inequality. Both movements have strong interests in supporting strict environmental standards — end subsidies, and their financiers. Our two movements share many of the same enemies — and one cannot succeed without the other.

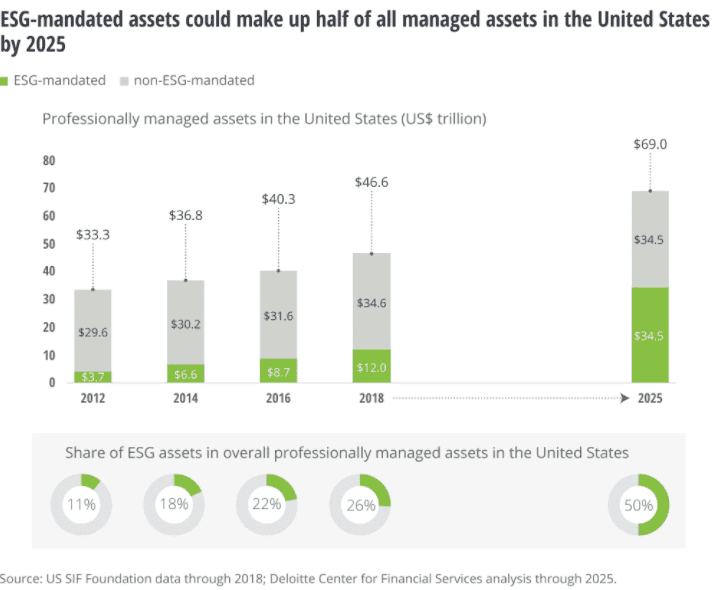

A second, more technical approach involves a dedicated, extensive, permanent fight against greenwashing. The financial sector wants as large a portion as possible of bonds, shares and other financial assets to gain the ‘green’ label, whether to qualify for public subsidies or special treatment. According to one estimate, half of all of the nearly $70 trillion in managed assets in the US would bear the ESG (Environmental, Social and Governance) label by 2025.

That’s right: in the US alone, $35 trillion worth of assets would get the ESG stamp of approval! Imagine the potential for state subsidies for this. The solution is to regulate the private financial ratings agencies extremely heavily, eliminating all their incentives to greenwash. The climate movement must also fight against the polluters potent efforts to corrupt and greenwash the public sector ratings — notably the European Commission’s “EU Taxonomy for Sustainable Activities”. A sustained, focused, broad effort to harden up this taxonomy — and to get states to penalize polluting activities, rather than subsidies ‘green’ (or greenwashed) assets and activities — must now gather pace.

To understand a third way to neutralize this threat, it helps to understand the Finance Curse. The starting point is the concept of the resource curse, about which I wrote a 2007 book after spending nearly 15 years living in and writing about oil-rich countries along Africa’s western coastline. In too many cases, vast amounts of oil money flowing into these countries has not been harnessed effectively for development. But my research suggests it might be worse than that. Many nations rich in minerals like oil end up paradoxically poorer, more unequal, more corrupt, and slower-growing than comparable countries without minerals. This is the premise of the resource curse. It is a contested thesis, but in some cases, it is clear that hitting the resource jackpot has become a developmental disadvantage.

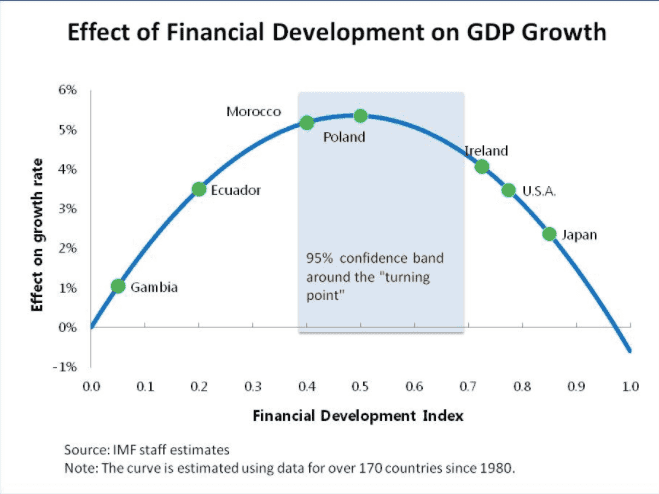

The most important lesson we can learn from the resource curse, however, is that it turns out that countries with oversized financial sectors — including the United States, the United Kingdom, and many others — are actively harmed by their financial sectors. This IMF graph, repeated in a number of other studies, shows the basic relationship. We all need finance, to help us save, to channel our savings into productive investment, to provide ATM machines, and so on: the useful stuff. Countries without adequate financial infrastructure should expand their financial sectors carefully, to improve prosperity. But these graphs show that there is an optimal point — the United States and United Kingdom passed it sometime in the 1980s — at which the financial sector provides all the services an economy needs. If it grows beyond this point, it starts to undermine prosperity. Many if not most European countries lie on the wrong side of this threshold.

Why does too much finance make us poorer? For one thing, the dominant sector, whether oil or the financial sector, can suck all the best educated and most talented people, capital, and entrepreneurial energies out of other economic sectors. It generates a giant ‘brain drain’ from agriculture, industry, tourism, creative services, and other economic sectors — not to mention from government and from civil society — and into the dominant, high-paying sector. High pay for a relative few, which harms other sectors, also directly worsens inequality. A further round of damage is inflicted by regular economic crises, whether from roller-coaster oil prices, or from global financial crises.

The next reason is more complex, but probably the more important: wealth extraction. In the case of an oilfield, you drill into nature’s bounty, extract the oil, and policy attention to other sectors can be neglected as people sit back comfortably and watch the oil money flow obligingly into the bank. In the case of finance, attention turns away from engaging in and supporting productive activities, towards more extractive activities that enable the sector to get rich off the toil of others. They aren’t drilling into the ground, but into the pockets of other businesses and citizens.

The tricks are many. One is too-big-to-fail banking, which enables bankers to get rich when times are good, and when their risks finally turn sour, as has already happened with the Covid-19 crisis, to be rescued at taxpayers’ expense because they have become so systemically essential. Another is through mergers and acquisitions with the purpose of constructing monopolies and market power to extract more wealth from suppliers, workers, consumers, and often from government. Another set of tricks involves private equity firms buying up companies across the economy, then financially engineering them for profit. They run their financial affairs through tax havens, to extract wealth from taxpayers. They cut wages and pensions, extracting wealth from current and past workers. They make the companies they buy take on huge debt — which magnify profits in good times, then use limited liability protections to ensure that the pain falls on creditors’ and society’s shoulders when things go wrong. Once you start looking for it, you will find financial predation everywhere, across all economies, rich and poor.

That’s the finance curse, in a nutshell: too much finance makes us poorer — and the main reason for this is predatory wealth extraction. A key victim of this extraction, of course, is the environment. The financial sector, if given too big and too free a role, ultimately will extract huge resources in “the greatest commercial opportunity of our time,” depriving governments and businesses of the resources needed to move to a low-carbon economy.

The implication of the IMF graph above is that if countries want to prosper more, they should shrink their financial sectors. How? Start with the fact that the financial sector has two parts: a useful set of services, surrounded by a ring of predation. Shrink the predatory part, and keep the useful stuff. A smaller, better financial sector means greater prosperity for the country that hosts it, and a better-organised economy with less predation will have more resources available to finance climate transition.

In terms of the climate crisis, the specific way to achieve “smart shrinkage” is to push back directly against the Wall Street Climate Consensus: to move states away from subsidizing the “greatest commercial opportunity of all time,” and towards properly penalizing polluting activities and getting the state to raise and spend the resources instead through borrowing and monetary policy. The climate movement, for its part, needs to understand and then oppose the “Black Zero, nudge and incentivize,” outsource to the City of London. The economic justice movement must support this with a push for “smart shrinkage” of finance more broadly.

The finance curse analysis achieves another goal too. Many people have a vague sense that the bigger and wealthier a country’s financial sector, the bigger and wealthier the country will be. Thinking along these lines, they often oppose higher taxes or stronger regulation of the financial sector because they fear it will ‘discourage investment.’ There is an ugly trade-off, they think, between taxing and regulating finance, and their own prosperity. We want to penalize polluting activities, but this will discourage investment, shrink the financial sector, and make us poorer, they think. This logic is not just confused — it is a recipe for inaction.

Once people understand instinctively the idea of ‘shrinking finance for prosperity,’ this ugly trade-off falls away. We might well be able to have our pie and eat it. We can reduce the political power of the financial sector, we can have stronger environmental regulations, we can have lower inequality — and in the process, we won’t just redistribute the pie more fairly with better regard to the environment: we will expand the pie too. We’ll be better off all round. To tackle global warming effectively, we must shrink the financial sector. Smash the Wall Street Climate Consensus. And break the finance curse.

Photo: ckilger