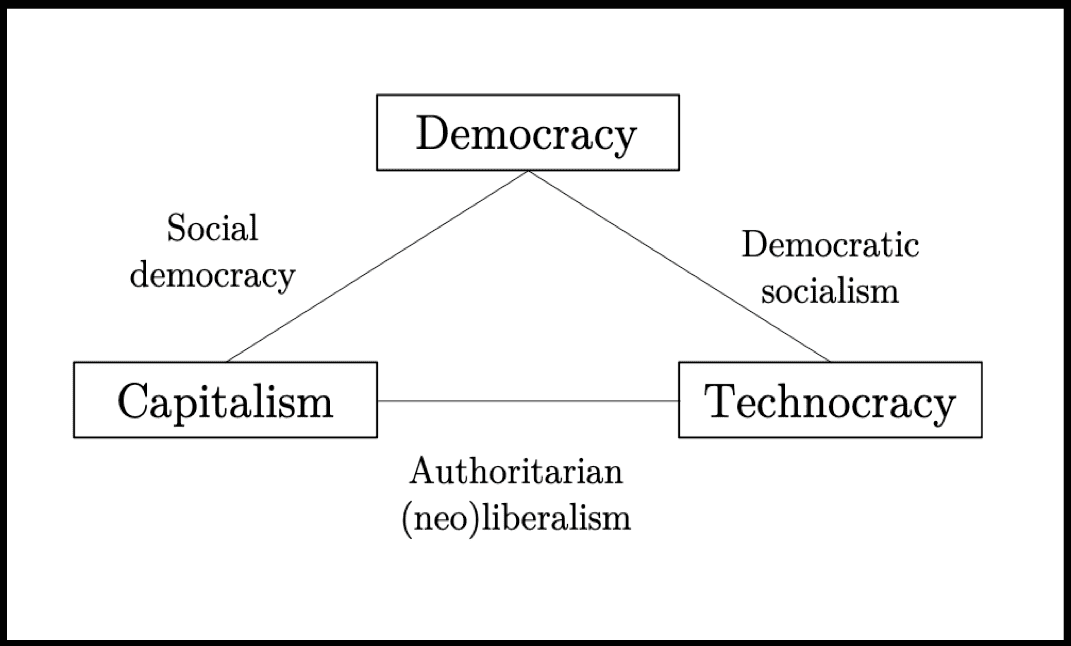

That marriage experienced a honeymoon (‘Golden Age’), before the relationship became increasingly troubled under conditions of globalization and financialization. This narrative has, of course, been debunked: prosperity and freedom in the Global North have been predicated on exploitation and oppression in the Global South. My starting point, however, is a second line of critique, which questions the marriage narrative primarily on domestic political grounds: Instead of a marriage of democracy and capitalism, we should think of the post-war era as an uneasy cohabitation of capitalism, democracy, and technocracy.

The three sides of the capitalism-democracy-technocracy triangle represent alternative institutional solutions to the problem of organizing and coordinating economic activity (in reality, these solutions often overlap). Under the post-New Deal, pre-globalization conditions of the Bretton Woods period (from the end of the war until 1971), the Global North-West successfully married capitalism and democracy under a broadly Keynesian policy regime (“social democracy”). Financial globalization gradually eroded this arrangement. As social democracy morphed into the ‘Third Way’ typified by the Blair and Clinton governments of the 1990s, which promoted austerity and central banks independence, fiscal space and democratic choice shrank. The global financial crisis consolidated this shift towards the capitalism-technocracy axis — most dramatically in the euro area, where national governments received orders from the European Central Bank. Putting the emphasis on the loss of democratic choice and self-determination, critics dubbed the new alignment “authoritarian (neo)liberalism”.

Figure 1: The Democracy – Capitalism – Technocracy Trilemma

Where things get interesting is the third side of the triangle — let’s call it “democratic socialism.” To see why returning to tried and tested social democracy may not be an option, it is important to consider how historical circumstances have changed. The social democratic settlement arose from a situation in which the Great Depression and two world wars had reduced the global economy to what Perry Mehrling calls a “financially underdeveloped state.” As a result of World War II, the state had considerable influence over key sectors of the economy, unions were strong, and managers of large, financially independent, and domestically anchored corporations believed in the Fordist ‘high-wage, high-consumption’ growth model. In this mixed economy, capital and democratically elected governments depended on each other.

The situation today is different. Financialized capitalism poses a much greater obstacle to distributive justice, political equality, and, crucially, climate sustainability. In pursuit of the lowest possible wage and tax bills and the optimal financial and legal structure, corporations have self-fragmented across the globe. Corporations, and increasingly our homes and infrastructures, are owned by powerful financial investors who manage the wealth of the world’s wealthy elite. Unlike the Fordist managers of the past, this financialized capital depends not on sustainable relationships with other local stakeholders but on independent central banks and arbitration courts to protect it against local democracy. Under current conditions, it is doubtful whether there remains a direct path back to the social democratic capitalism of old.

Can a new path towards a progressive future be forged? Progressives correctly see ‘actually existing technocracy’ as a mode of governance geared towards protecting financialized capitalism against electoral majorities, and should be skeptical of naïve ideas of ‘progressive technocracy’ within the current institutional order. That said, reclaiming the fiscal and monetary power of the state and mobilizing it in service of progressive goals is going to be a technocratic — in addition to a political — project.

Technocracy

Technocrats form a sub-group of bureaucrats. They possess specialized knowledge and, unlike mere technicians, they occupy positions of power in the apparatus of government. Technocracy is “a system of governance in which technically trained experts rule by virtue of their specialized knowledge and position in dominant political and economic institutions”. Both authoritarian and democratic states rely heavily on technocratic rule. Prominent cases include authoritarian neoliberalism in Chile, authoritarian state-capitalism in China, developmental state capitalism in East Asia.

In much of the rest of the world, technocracy used to keep a slightly lower profile: the mostly hidden-from-view work of inflation targeting by independent central banks for the West, for example, or the policy work to meet the demands of IMF conditionality for the rest.

As Robert Dahl once noted, democratic societies may face a trade-off between “system effectiveness and citizen participation.” Towards the end of the twentieth century, in a climate of post-cold war triumphalism on the right and capitulation on the left, an optimistic view of technocracy took hold. The consensus in political science was that the “output legitimacy” produced by higher effectiveness could compensate for losses in the “input legitimacy” that resulted from lower citizen participation. Since then, however, things have changed.

The area of technocratic governance that has seen the greatest increase of unelected power has no doubt been central banking. Following the stagflation crisis of the 1970s and Paul Volcker’s labour-crushing crackdown on inflation in the US in the early 1980s, countries around the world transferred the responsibility for monetary policy from those directly accountable to elected representatives to arms-length technocrats governing newly “independent” central banks. By limiting that independence to relatively narrow price-stability mandates, the argument went, this institutional arrangement would strike a balance between the needs of financialized capitalism and the requirements of democracy. That was not, however, how things have since played out.

Contrary to the narrative that central bank independence constituted a form of depoliticized, welfare-maximizing economic management, central banks retained extraordinary power to determine distributional outcomes. The full scale of that power became apparent in the wake of the global financial crisis of 2008. Central banks’ unlimited liquidity operations and asset purchases highlighted their capacity to do ‘whatever it takes’ to support those they deemed worthy of support, while remaining largely insulated from democratic control.

To be very clear, the problem with central bank responses to the failure of Lehman Brothers in 2008 and the coronavirus pandemic in 2020 is not that they acted swiftly and on an unprecedented scale to prevent further economic damage. The problem is that central bank activism is highly asymmetrical and perpetuates a deeply unjust and destructive private financial system. In one sense, this is the good news: central bank planning is already here. The bad news is that this planning is carried out as a mere support function, subordinated to the profit-oriented planning capacity of the private financial system.

The worst of both worlds: central bank planning for private profit

In theory, the macroeconomic coordination problem has two ‘pure’ solutions. It can be solved either (a) in centralized fashion by a social planner; or (b) by Hayekian speculators whose decentralized actions are coordinated via market pricing. These “pure” solutions are ideal types; in practice, we all live in mixed economies: non-market institutions and the price mechanism each do a good amount of coordinating. The problem is that what planning capacity we have left has effectively been usurped by the private financial sector.

In financialized capitalism, the most important central institution is the central bank. Central banking always carries an element of central planning: monetary policy involves the purposeful manipulation of a key price in the economy, namely the price of short-term liquidity. Since 2008, however, the scale and scope of central bank planning have grown far beyond that. There are obvious examples, like large-scale asset purchases (“quantitative easing”), which directly target long-term interest rates while putting a floor under the price of financial assets. Prior to the coronavirus pandemic, for example, the Bank of Japan held 49% of domestic corporate bonds and 65% of domestic exchange-traded funds. Central banks’ market-shaping activities are less visible but equally consequential. They have built or re-shaped money markets and markets for asset-backed securities, as well as the infrastructures for payments and securities settlement. They have further increased their footprints in the financial system by institutionalizing international currency swap lines, by establishing permanent dealer-of-last-resort facilities, and through macroprudential regulation and stress tests.

The question is: What strategic vision guides how technocrats wield this formidable instrument of sovereign power? Who or what are central banks planning for?

The answer is, of course, the private financial system. And rather than a decentralized system coordinated by market prices, private finance itself has come increasingly to resemble a centrally planned system: global investment priorities are a function not of the decisions of millions of Hayekian speculators but of the business models of a few dozen, extremely large banks and asset managers. Banks invest in mortgages; asset managers in whichever firms are in market-capitalization-weighted indices; private equity firms in urban real estate; and venture capital firms in scalable rent-extraction models. This sector is highly concentrated at the top, where a few giant companies — banks, hedge funds, private equity funds — exercise considerable control over the direction of global capital flows. They are, in effect, the central planners of the wealth-owning class.

Rather than providing a corrective to the inefficiencies and inequities of this mode of capital allocation, central bank planning has long been geared towards expanding and stabilizing it. The 2008 financial crisis did not change this pattern of central bank-led financialization. The shadow bank system will not establish sufficiently liquid and standardized, pan-European repo or securitization markets on its own? The European Central Bank will help. The private system of securities settlement is inefficient and creates frictions in capital markets? The ECB will build a better, publicly operated system. Asset markets regularly seize up, threatening the expansion of the financial sector? Central banks will create backstops and dealer-of-last-resort facilities, thus effectively underwriting the ability of hedge and private equity funds to gobble up assets amidst economic disasters.

The upshot is that while central bank planning already exists, it is currently geared towards propping up a system in which the planning of investment is actually done by the private financial sector. This system is both deeply unjust and inefficient. Central banks have become the lenders of last resort for a manifestly unsustainable status quo.

Socialize central bank planning

Can central banks be turned into progressive institutions? Among observers from across the ideological spectrum, the overwhelming consensus has been that central banks must be cut down to size and made more democratically accountable. Progressives, however, should consider an alternative path towards democratizing central banking — to cut the private financial system down to size and double down on central bank planning.

It is important to be very clear: while private financial institutions wield extraordinary power in the economy, the ultimate source of that power is the state. Legal scholars Robert Hockett and Saule Omarova have coined the apt phrase “finance franchise” to describe an arrangement in which private banks act as “franchisees” of citizens, with the power to act with the full faith and credit of the public. This model, which in the United States acquired its contemporary shape between the establishment of the Federal Reserve in 1913 and President Roosevelt’s New Deal reforms of the banking system in the early 1930s, was premised on the twin assumptions that capital was scarce and that private actors were best able to allocate it to its most productive uses. Neither of these assumptions holds today. Capital is abundant, and private capital allocation has created vast inequality within and between nations, and brought the planet to the brink of climate catastrophe and environmental collapse.

The franchisees have had a good run. Now it is time for the public to cut out the middleman. The task it not easy. Progressive need to think carefully about the architecture of a financial system in which the creation of credit and the allocation of capital are subject to public rather than private planning.

Again, the good news is that central bank planning is already here. The present reality of central bank planning already undercuts the textbook arguments for delegating monetary policy to independent central banks. First, the many ways in which central banks steer, shape, and build financial markets invalidates the market neutrality principle. The notion that monetary policy has (or should have) only a negligible footprint in the economy has long been a myth, which is why proposing to put that footprint to progressive use should not worry us. Second, central banks have many more tools at their disposal than implied by the so-called Tinbergen rule, according to which a single instrument (such as the short-term interest rate) can only be deployed to achieve a single goal (such as price stability). Long a foundational principle for monetary policy, applying the Tinbergen rule to central banks is nonsensical. It is much more accurate to compare the central bank to a Swiss army knife — an apparatus that contains many different instruments and that can therefore be deployed in pursuit of several different goals.

Re-orienting central bank planning from private profit towards public purpose is both possible and desirable. It is only possible, however, as part of a full-scale overhaul of the financial system, key components of which should be nationalized. While this is not the place to go into the details, two points are worth highlighting. First, while progressive should think big and bold, it is also important to recognize that we have been here — extreme inequality, financial collapse, economic depression — before. The New Deal period offers many examples of policies and public financial institutions that can serve as guideposts. What is more, key thinkers of the New Deal period had first-hand experience in actual economic planning – Adolf Berle served as legal counsel to the Reconstruction Finance Corporation and John Kenneth Galbraith helped run the government’s Office of Price Administration during World War II. As Sarah Quinn and her co-authors show, Berle’s ideas for “modern financial tool-kit” provide an excellent starting point for thinking about radical reforms to democratize the financial system today. Indeed, the left’s capacity to develop sophisticated, actionable economic policy blueprints is growing fast. TINA (“there is no alternative”) was yesterday — today, progressives “have a plan for that”.

The second point worth highlighting is that a progressive agenda for finance must be an international agenda. Whereas in retrospect the 2008 financial crisis did not wipe the slate clean enough, the economic and political fallout from the coronavirus pandemic may produce a rare opportunity to re-negotiate the international financial order. The pandemic’s repercussions expose, again, the devastating dependence of the global financial system on the U.S. dollar and hence the Federal Reserve. By late March 2020, capital outflows from emerging market economies have exceeded all previous episodes of capital flight. Lives were on the line already in 2008-09, but the human cost of the existing system is on much starker display today — a swap line from the Fed is literally a matter of life and death. Global warming, environmental degradation, and pandemics are global problems with global feedback effects — there’s very little prospect of combating these problems without a more balanced, multilateral financial order.

Conclusion

As the world emerges from the coronavirus pandemic, there will be a once-in-a-century opportunity to rebuild the global economic order. The age of TINA is over, and the alternatives could not be starker. While the fiction of an enlightened neoliberal technocracy is dead, neoliberalism will survive in its openly authoritarian and nationalist variants — see Brazil and the United States. The alternative is both political and economic democracy. One of the key conditions to make this a viable alternative is the transformation of central banking. Central bank planning is already here, but is geared towards propping up the profit rate in an oversized, extractive financial system. The remedy requires a major political and a minor technocratic revolution: turn the financial system into a utility-like sector geared towards the public good, and socialize central bank planning.

Photo: Paul Roberts