The depth and breadth of global “debtification” is difficult to overstate. From a rudimentary financial instrument that aroused philosophical intrigue and religious suspicion, debt has become a master framework for the problems — and proposed solutions — that face governments, firms, and households alike. In the Global North, the stagnation of worker incomes and soaring costs of living have been plugged by mortgages and consumer loans. In the United States, for example, household debt tops $14 trillion, more than three times the size of the combined economies of the entire South America. In the Global South, meanwhile, a vacuum of economic opportunity has been filled by a “microfinance” industry that lends at interest rates few can afford; private-sector debt in the Global South has doubled in the last decade — and quintupled since 1970 alone.

Figure 1: Evolution of debt

The pandemic has since amplified the global debt wave into a virtual “tsunami”. In the first nine months of 2020 alone, governments and companies worldwide took on $15 trillion of additional borrowing, $5 trillion more than during all of 2019. The scale and speed of such borrowing is unprecedented in history. But so are the politics. The recent debt tsunami has been welcomed by pundits and politicians that would have considered it unfathomable just a decade ago.

Instead, the pandemic marks a critical juncture in the debt justice movement because those extra trillions are now breaking the camel’s back: in the course of this pandemic, the injustices of the global financial system have been thrown into sharper relief than ever before. This is a system organized to secure the power of creditors over debtors; to ensures that access to credit is easy and riskless for the most predatory financial firms, while making borrowing hazardous and often ruinous for students, families, or small-scale farmers; to guarantee that sovereign bond holders get repaid by forcing governments to eliminate welfare programs or cut health budgets.

Uncounted lives have been sacrificed on the altar of debt repayment — and following the tsunami of 2020, uncounted more are being marched toward it.

Debt is the main mechanism by which people, firms, or governments meet current consumption or investment expenditures when they don’t have the required cash at hand. Without a mechanism to borrow from the future, only the most profitable or wealthiest actors in the economy could make investments: a clearly regressive arrangement. At most times and in most places, access to borrowing is an essential component of economic life, however, the credit-debt relationship has been an unequal one, subjugating the debtor to the coercive power of the creditor.

At no time and in no place has this inequality been greater than here and now. Scholarship on the explosion of global debt since the 1970s has emphasized three interconnected drivers. First, the politics of ‘neo-liberalism’ have encouraged governments across the world to privatize public infrastructures and cut public services in the name of market efficiency. Second, the liberalization and privatization of the economy has enabled the explosion of the financial sector, as households are forced to borrow their way toward goods like education, health, and housing — goods that were once publicly provided. Third, the deregulation of that financial sector has increased the ability of global elites to move capital across borders, while reducing the capacity of societies — especially in the Global South — to protect themselves against the extractive and predatory practices of financial investors.

Debt is a weapon wielded by the rich against the poor in both core and periphery, but the conditions and configurations differ greatly across contexts.

At the core of the system, a handful of states, financial firms and multinational corporations reap enormous gains from their unmatched ability to borrow. Indeed, the most predatory actors in the financial system have fared best: for the largest hedge funds, 2020 was the most profitable year in a decade. Amidst a global pandemic, these firms exploited the availability of unlimited credit—underwritten by unprecedented and unconditional liquidity support provided by the US Fed and other central banks—to gobble up firms, land, and infrastructures at fire sale prices. The richest countries with the highest credit ratings enjoy a similar privilege. They take on debt—and rightly so—to protect their citizens’ incomes and bolster health systems and other public services that are essential for guaranteeing people's socioeconomic rights.

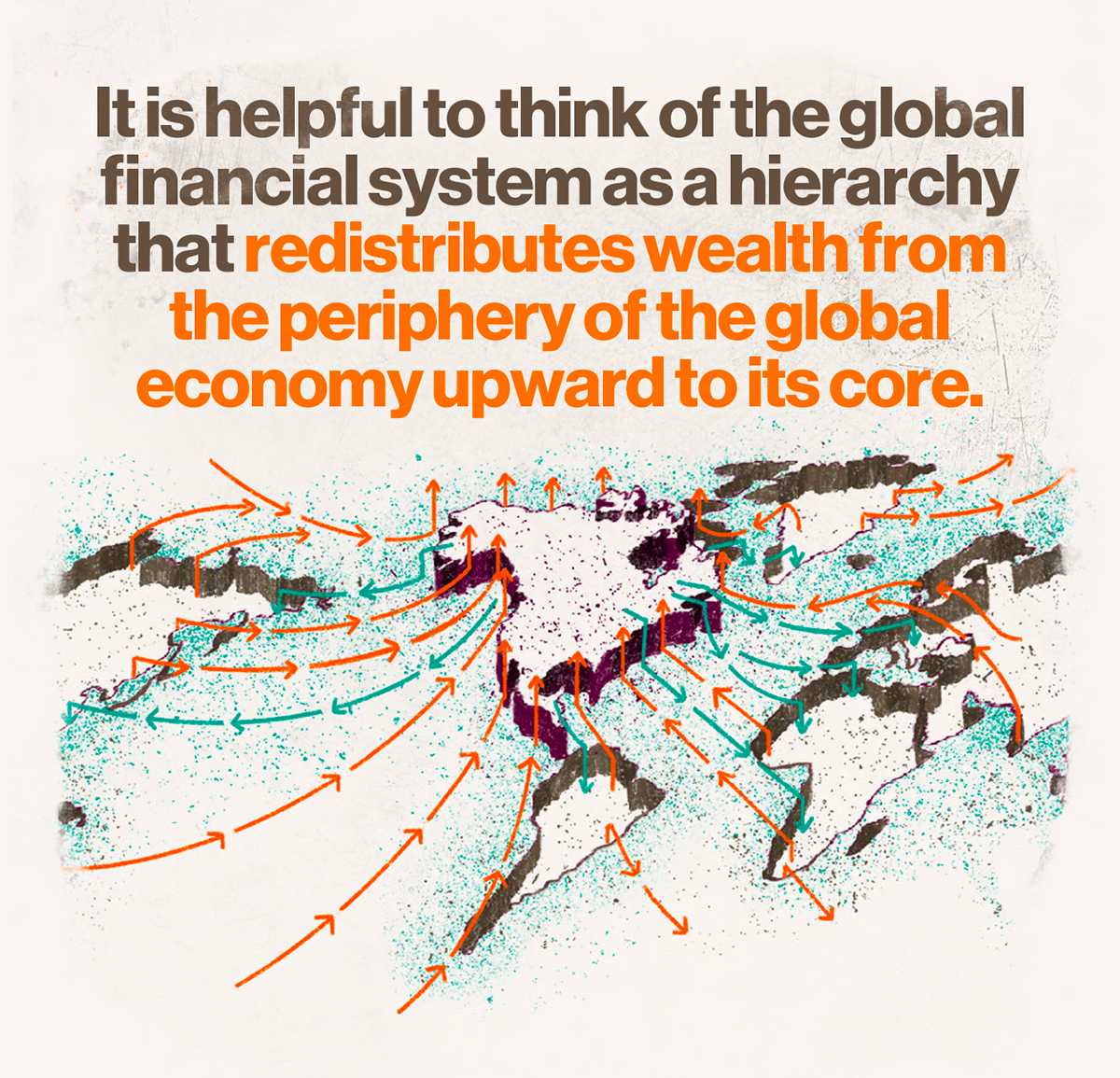

The dominance of the US dollar in global markets for capital, goods, and resources forces countries in the Global South to borrow in a foreign currency. US dollar borrowing from private foreign lenders took off during the oil crises of the 1970s. Whereas government borrowing reached a temporary peak amidst vicious debt crises in the late 1980s, private-sector borrowing by firms and banks continued to rise (see Figure 1). Since the global financial crisis, emerging market issuance—public and private—of US-dollar denominated debt has further accelerated, reaching an all-time high of $640 billion in 2020.

There are two major problems with all this foreign debt. Even during good times, when investors from the Global North are eager to lend to borrowers in the Global South, they do so at high interest rates: a key mechanism through which the upward redistribution from periphery to the core takes place. However, it is when the tide of capital turns that the deeply unequal nature of the US-dollar dominated global financial system manifests itself most visibly. Global South borrowers frequently lose access to private foreign capital—not because of “policy errors” or “over-borrowing”, but simply because the global financial cycle enters a new phase, most likely because the US Fed tightened its monetary policy. What has come to be called the “global financial safety net” is vastly inadequate, and for most countries the International Monetary Fund becomes the only source of US dollars.

But IMF loans come with costs —particularly in the form of conditionality agreements that require borrowing countries to implement detailed lists of structural reforms. The public-health-diminishing and inequality-increasing consequences of IMF conditionality have been established by empirical studies of hundreds of cases (see, for example, here and here). Still, governments often see no alternative. In the absence of sovereign debt restructuring mechanisms, countries defaulting on foreign debt risk losing access to foreign credit and fear being targeted by vulture funds. The result is that tax revenues are diverted to debt repayment, regardless of the domestic economic and social cost. In April 2020 — as the pandemic ripped around the world — 60 countries paid more to service their debts than they did to provide public health.

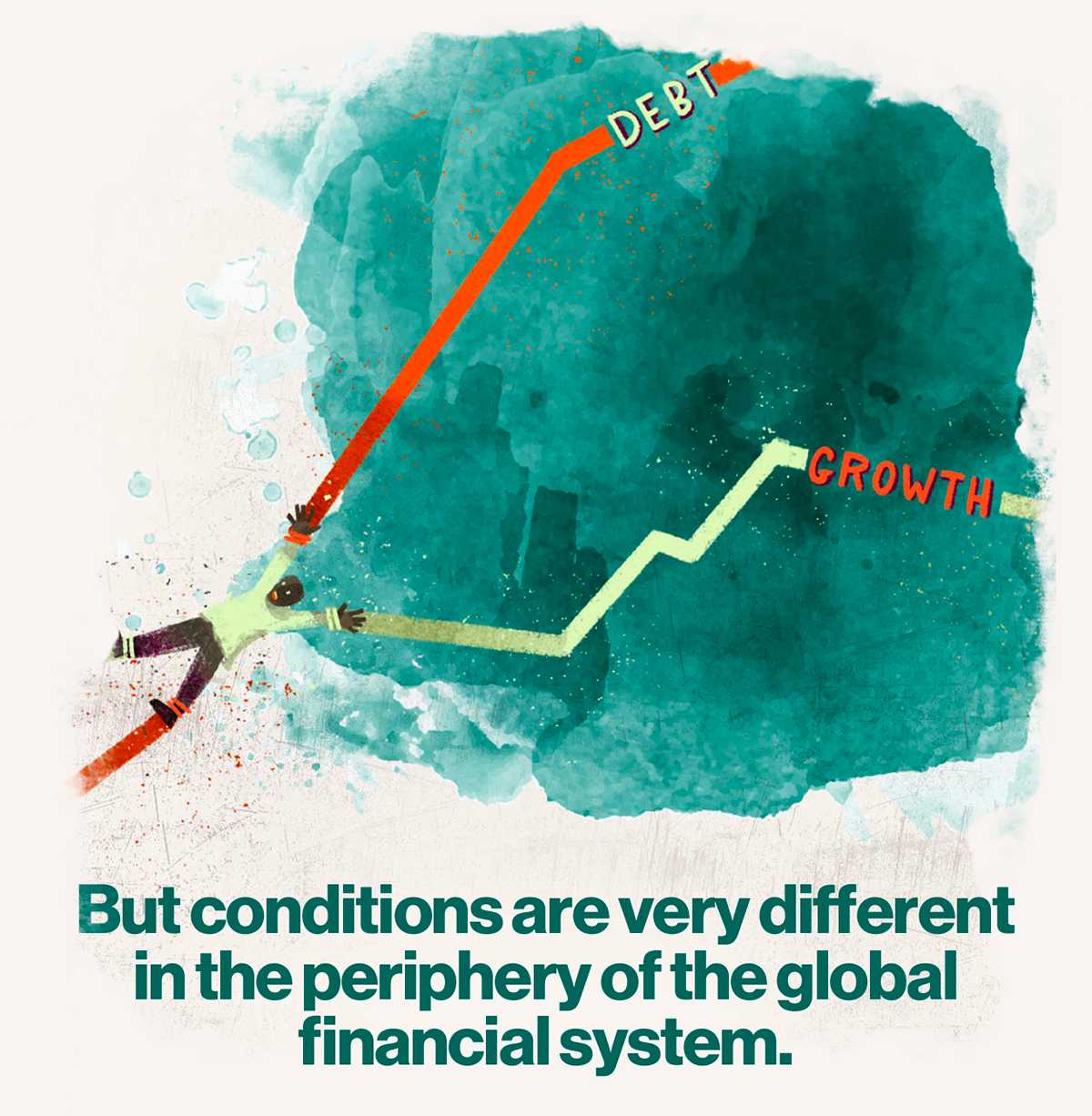

Over the past two decades, public-sector debt as a share of GDP has held relatively steady in the Global South. But private-sector debt has doubled. This distribution is not incidental. Rather, it is part and parcel of the same dynamic of structural adjustment: the IMF imposes conditions that force governments to cut social programs, and households are forced to pay for them on their own. A similar logic of austerity applies in the Global North. The slow but steady destruction of public education in countries like the United States, for example, has led to an explosion of student debt. The withering of the welfare state in the Global North and its underdevelopment in the Global South therefore produce the same effect: a great shift of social risk onto the shoulders of our societies’ marginalized groups: women, communities of colour, and the poor.

Paradoxically, debt has been sold as the solution to these problems of poverty. Microfinance — the provision of small loans to households that were historically considered too ‘high risk’ to merit financial inclusion — remains a pillar of developmental economics today. From a small set of financial institutions in the 1980s, microfinance has grown into a multi-billion-dollar global industry. Its figurehead Muhammad Yunus was given a Nobel Peace Prize for pioneering microloans in Bangladesh; the World Bank has adopted this model and aggressively supported its expansion into across the Global South. Less attention has been paid, however, to the extortionate rates of interest at which these micro-loans are offered. In the Global North, average rates of interest on mortgages, for example, move between 1.5 and 3 percent. The average rate for microfinance is more than 30 percent — and in countries like Mexico, that number moves up to 80. This is yet another stunning illustration of how core-periphery relations operate. Advocates of microfinance argue that access to liquidity is better than none. But the human costs of such extortion are everywhere to see: from suicides of indebted farmers India to sweeping evictions of indebted households in Cambodia to the incarceration of indebted women in Sierra Leone. “Financial inclusion”, as we will argue in this collection, is often just another name for financial extraction.

It is the primary contention of this collection that all these disparate dynamics — hedge funds raking in pandemic profits, students struggling to afford an education, micro-borrowers on the brink of bankruptcy — are different manifestations of the same basic structural mechanism at the heart of the global financial system: the privatization of gains and the socialization losses.

The members of this working group share a common goal: to end that cycle.

We are under no illusions regarding the enormity of that goal. Debt runs deep in the bloodstream of the global economy. The delivery of debt justice will require nothing short of a wholesale transformation of our political economic institutions from the local level to the international.

Figure 2: Emerging and developing economy debt since 1970; debt as a share of GDP

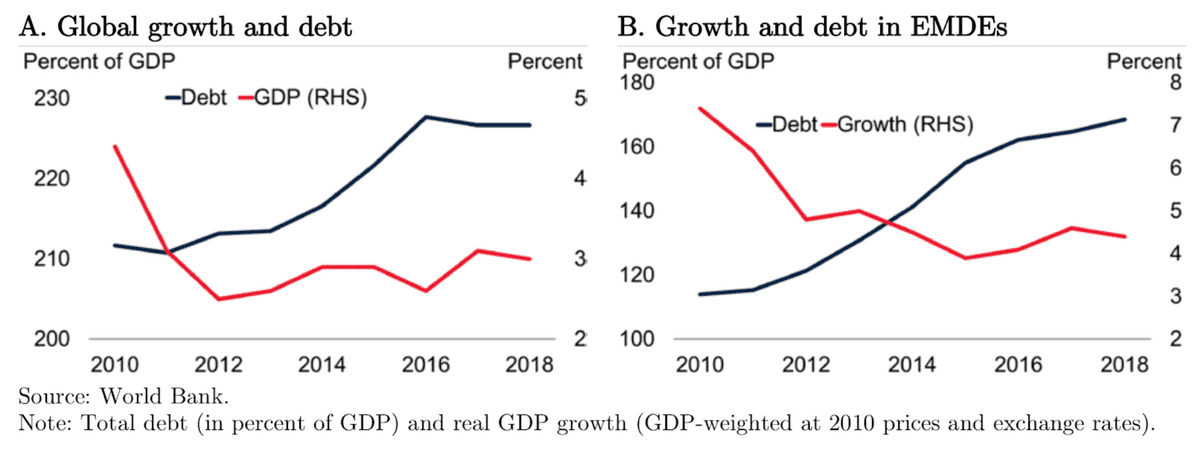

Figure 3: Debt and growth since 2010, global (A) emerging market and developing economies (B)

Source: Alam, Zohair, Mr Adrian Alter, Jesse Eiseman, Mr RG Gelos, Mr Heedon Kang, Mr Machiko Narita, Erlend Nier, and Naixi Wang. Digging deeper--Evidence on the effects of macroprudential policies from a new database. IMF Working Paper 19/33. International Monetary Fund, 2019.

It is in that spirit that we have convened this collection: to develop a blueprint of debt justice — a map of where we go from here, and how movements around the world can combine forces to get there. Combining a systematic critique of the international financial system with a comprehensive vision for its transformation, this collection aims to stand with activists around the world, armed with the facts, figures, and analytical frameworks to make sense of the present crisis and to break out of it.

Over the coming weeks, we will publish a series of essays that tackle the different dimensions of debt, confront policy questions with progressive principles, and build a common vocabulary for the struggle of debt justice. As a diverse group, we have enjoyed bringing our perspectives, experiences, and interests to this collection, and our hope is that you see some of that joy reflected in these essays. Together, the contributions to this collection form a living document — and we invite friends and readers around the world to add and respond to its contents.

This collection is the product of the conviction, commitment, and generosity of its many contributors — long zooms and longer email chains traded across oceans and between time zones. We are immensely grateful to the members of the Debt Justice Collective who dealt with rounds of edits with incredible patience. We also want to thank our coordinators Mitali Nagrecha, Beatriz Esperanca, and Varsha Gandikota-Nellutla for bringing us all together; our scrappy editorial team of Candice Vianna, James Schneider, Ana Arendar, Paweł Wargan, David Adler, Gurshabad Grover, and Isabel do Campo; Gabriel Silviera, Cèsar Caprioli, and Pia Alize for creating a powerful visual language of debt justice; Tim Swillens, Maria Inés Cuervo, and the entire translations team for bringing this work into new languages everyday; and a very special thanks to Benjamin Braun.

The Collection

1. Debt and Power: A snapshot of the indebted world as a map of power. Debt today is too often the power to oppress and exploit. But, debt is also a source of collective power of debtors everywhere, and for governments to invest in their people.

- Debt as Colonialism – Joan Chaker for Public Works Studio

- Debt as Racial Capitalism – John Robinson III

- Debt as Surveillance – Nicholas Loubere

- Debt as Exploitation – Osama Diab

- Debt as Collective Strength – Philip Mader and Christy Thornton

- Debt as Gendered Oppression - Jalahan Amara Jakema, Richelle Brooks, and Rhiannon Davis

2. A Vision of Debt Justice: A comprehensive set of principles that define our vision of debt justice for the workers and peoples of the world.

- No Illegitimate Debts – Lidy Nacpil

- Rights Not Debts – Allison Corkery, Ignacio Saiz, Juan Pablo Bohoslavsky

- Our Debt Is Not Your Profit – Adrian Falco

- Investment Not Extraction - Melinda Cooper

- No More Global Debt Inequalities - Jayati Ghosh and Ingrid Kvangraven

3. The Debt Justice Agenda: An expansive policy agenda to deliver on the principles of debt justice set out in the previous section.

- Bailout the People – Katharina Pistor

- Delete the Debt – Gilad Isaacs and Sonia Phalatse

- Take Back Our Institutions – Crystal Simeoni, Miriam Brett

- Socialize, Don’t Financialize – Fareen Parvez, Martino Comelli

- Democratize Finance - Thomas Marois

- Make Banking Cooperative – Carolyn Sissoko

- Pay Reparations and Redistribute Prosperity – Matthias Goldmann

- Climate Justice Means Debt Justice –Tess Woolfenden and Jerome Phelps

Illustrations by Pia Alizé.