This essay is part of the “Debt Justice Agenda” series of Progressive International’s Debt Justice Blueprint.

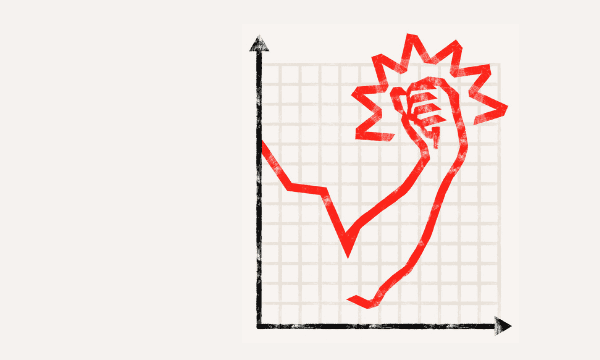

The towering African intellectual Samir Amin argued that global capitalism, and the embedded unequal relationship between the centre and periphery, was reproduced by five monopolies, one of which was the monopoly over finance. This essay calls for an end to this monopoly and the death of debt supremacy.

For many African countries, particularly commodity-dependent ones such as Mozambique, Congo and Djibouti, external debt-to-GDP has risen to more than 100% since the onset of the COVID-19 pandemic, forcing the impossible choice between repaying debts or addressing pandemic-induced needs. In November 2020, Zambia became the first African country to default on its $425 million Eurobond repayments. Whereas the rich world is borrowing at record-low (close to zero) interest rates, African countries are paying interest rates between 5-16% on 10-year government bonds.

Debt relief and cancellation is the only viable way to give African states the space to prioritise saving livelihoods during this pandemic and ensure a just recovery thereafter.

The burden of debt

The burden of debt can be crippling. By the end of 2020, African governments had only budgeted about 2.6% of total GDP for COVID-19-related spending, compared to the 11.2% of GDP allocated by G20 countries. Even prior to the COVID-19 crisis, as many as 30 African countries were spending more on servicing sovereign debt than on healthcare. According to the World Bank, the pandemic has already triggered the first recession in Sub-Saharan Africa in 25 years. This is in tandem with a deepening humanitarian crisis, as more and more people plummet into poverty.

As debt obligations grow, more states will likely resort to austerity measures, particularly cuts to social services such as in healthcare and education. A full-blown debt crisis would plunge the continent into a deep social and economic crisis, with dire implications for the ability of governments to meet their commitments on gender equality and the promotion of women’s rights. In either scenario, the burden of unpaid social reproductive work, undertaken mainly by women, will rise as states transfer the responsibility of care from public institutions to under-resourced households still reeling from the crisis of social reproduction aggravated by structural adjustment programmes from three decades ago.

The past and the present

For scholars of African history and the millions that lived through the 1980s and 1990s, there must be a perverse sense of deja vu. The Structural Adjustment Programmes of that era, driven by the International Financial Institutions (IFIs) of the IMF and World Bank, prioritised the repayment of debt. The accompanying conditionalities led directly to a ‘lost decade’ for Africa that compounded the legacy of Europe’s colonial project in Africa by, for example, entrenching dependence on commodity exports.

A core component of the IFI-driven agenda was the hollowing out of national public services, such as healthcare. This has led directly to the eroding of the capacity of African states, capacity desperately needed to confront the COVID-19-induced crises. In Mali, for example, the IMF encouraged less healthcare spending as part of its adjustment programme, arguing that any spending above 3% of GDP would be ‘unsustainable’.

Today, IFIs are again entrenching debt dependency in Africa, including via new forms of extractive finance such as the World Bank’s Private Financing for Development agenda. This agenda sees the proliferation of financing structures, such as the widely criticised Public-Private Partnerships (PPPs), that centre the role of private debt to accelerate development in Africa.

Debt relief is merely putting a plaster on a gaping wound

While there have been growing calls for debt relief and temporary debt moratoriums from the international community, such as from the UN and the G20,, these do not go far enough as they lack a binding framework compelling private, public and multilateral lenders to halt debt repayments.

Private creditors have been unresponsive to widespread calls for debt relief. Their share of foreign debts for low- and lower-middle income governments increased from 25% in 2010 to 47% in 2018. BlackRock, a multi-trillion-dollar asset manager, holds close to US$1 billion of ‘Eurobonds’ in Ghana, Kenya, Nigeria, Senegal and Zambia alone. These private institutions will not voluntarily ease this debt burden. In September 2020, the G7 stated that “voluntary private sector participation has been absent, which has limited the potential benefits for several countries.” The financial power of private creditors allows them to punish non-paying countries regardless of the socioeconomic implications.

Bilateral and multilateral debtors have also been hesitant to forgo collection despite the outward show of support. While private bank lending accounts for much of the external debt of middle-income developing countries, most low-income African countries have borrowed more from multilateral financial institutions and bilateral creditors. As of December 2020, about 36% of African government external debt was owed to multilateral organisations such as the World Bank and IMF, and 32% to bilateral creditors (China holds 20%).

Effective debt suspension must make it compulsory for private, public and multilateral creditors to participate.

However, debt moratoriums or suspensions effectively just kick the can down the road, delaying what many have argued will be a widespread debt distress in Africa. Short-term debt freezes will not make available sufficient funds to finance COVID-19 rescue and recovery. There is also the risk that the requests for debt relief precipitates credit downgrades, increasing the cost of potential financing and limiting their ability to borrow in the long term.

Alternatives to an impossible choice

African states therefore face an unconscionable dilemma. Amin’s “monopoly over finance” has created a situation in which African countries – and the Global South more generally – are “damned if they do and damned if they don’t.” Resources are needed, but staunching the flow of debt service costs induces the risk of being cut off from any additional funding in the near future, and maintains the status quo that is the chronic inability of African states to adequately fund their COVID-19 response and recovery measures.

This dilemma rests on the subordinate integration of Global South countries into the global financial system, a colonial and imperial architecture that continues to unfairly reward wealthier nations. Contemporary capitalism sanctions debt supremacy at the expense of human flourishing and the realisation of inalienable socio-economic rights. This is sustained and reproduced by conservative economic orthodoxies at the national and international level. This state of affairs can only be reversed by concerted global action and collaboration, rooted in an acknowledgement of the historical forces that have led to this moment and the disruption of prevailing power relations and the intellectual edifices and material relations that sustain them.

The G20, together with IFIs, must initiate a coordinated effort to reduce debt in Africa through comprehensive debt restructuring and eventual write-off. Mechanisms employed must be transparent, free of creditors’ influence, and must prioritise human rights as a framework for advancing a just recovery from COVID-19. They must cover private, public and multilateral debt. In instances of extremely exploitative lending practices, or where lenders were complicit in human rights abuses, debts should be immediately and unilaterally cancelled.

An internationalist vision of debt justice must rebalance the power asymmetry of global finance, which remains premised on colonial extraction. African nations are articulating avenues of reform that are based in rights and social justice. Northern creditors must show meaningful solidarity by joining them in the push for long-lasting solutions that prevent reckless lending and ceaseless debt accumulation.

Gilad Isaacs and Sonia Phalatse are members of the Progressive International Debt Justice Collective.

Sonia Phalatse is a Researcher at the Institute for Economic Justice, Gilad Isaacs is the Director of the Institute.

Illustration by Namita Sunil. Namita is a New Delhi based illustrator and graphic artist.

From the Blueprint team at Progressive International

We live in a world of debt. The depth and breadth of global “debtification” is difficult to overstate. It is the primary contention of this collection that all these disparate dynamics — hedge funds raking in pandemic profits, students struggling to afford an education, micro-borrowers on the brink of bankruptcy — are different manifestations of the same basic structural mechanism at the heart of the global financial system: the endless cycle of privatized gains and socialized losses. Simply put, the rich get richer, while the poor, by design, remain poor.

The goal of this Collective is the goal of progressive movements around the world, to end that cycle. Read the full Debt Justice Blueprint here. If you’re interested in engaging with us, please write to the Varsha Gandikota-Nellutla, Blueprint Coordinator at [email protected].